Maersk Customs Services in Portugal

Local contact options

Contact us

Core product

Import customs clearance

Standard Full Customs Declaration, paying Duties & VAT upon arrival in the country in order to clear the cargo.

- Final import customs clearance

- Temporary import customs clearance

- Simplified customs clearance

- Customs & other authorities inspections

Export customs clearance

Standard Declaration to Customs to obtain permission to export cargo to non-EU destinations.

- Export customs clearence

- Certificates of origin / EUR.1

- T2L (EU origin) issuing + clearance

- Re-export declaration

Transit documents

A transit document allows the free movement of containers through European territories, suspending the payment of Duty and VAT until the destination.

- T1

Additional Maersk Customs Services

- Customs Quick Health Scan – A high level risk & control assessment of the customers business highlighting potential gaps and providing support and solutions where required.

- Peak Volume Management Programme – Assistance with daily Maersk Customs Services activities when the customer needs it most.

- Origin and Free Trade Agreements – Awareness & guidance on FTA’s & preferential origins.

- Classification Management – An overview of current Classification Databases or a Full End-to-end Reclassification Programme from our trained specialists.

* Costs will vary depending on the type of business, size & requirement – please refer enquiries to Customs Sales Department.

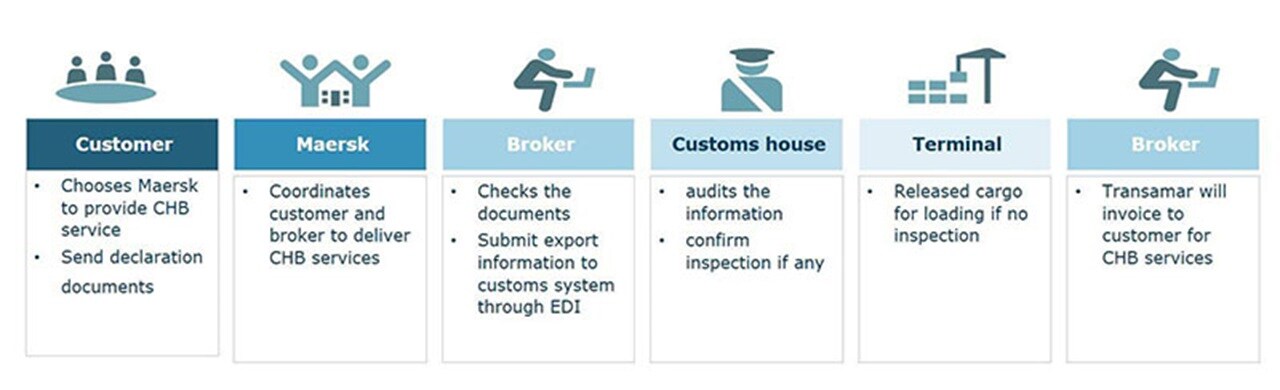

General export Maersk Customs Services flow

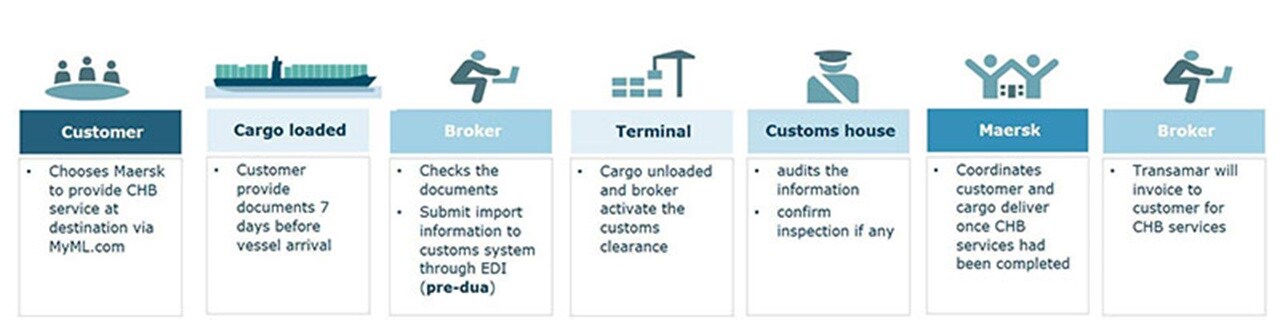

General import Maersk Customs Services flow

What is required to complete Maersk Customs Services?

Signed Power of Attorney (POA)

Signed by the buyer, on Company Letter Headed paper, with needed ID documents and commercial certificate. This grant’s permission for our Customs Team to complete CHB on behalf of the buyer and provides the required details to enable internal account creation.

Mandatory documents required:

- Signed POA

- Commercial invoice(s)

- Packing list(s)

EORI Number

The buyer must have a valid EORI and VAT number to hold a solid audit trail with customs authority and tax office & to be eligible to claim back any potential VAT paid.

Additional documents (where applicable) *

- Copy of the Bill of Lading

- Licences

- Health Certificates

- Preference Certificates

* Originals to be submitted to our Customs Team whenever necessary

For Abbreviations & Explanations, please check shipping terms.