Global economic conditions continue to worsen with record inflation, a fall in global manufacturing exports and the Russia-Ukraine conflict all hitting market sentiment. Consumer concerns over higher prices and full inventories in the US and Europe are also one of the reasons for a likely drop in retail lifestyle volumes between September-November, according to a Maersk survey. This will further pressure container shipping where the fall in demand has led Maersk to introduce further measures to match cargo volumes with capacity on key trade lanes from Asia and on the Transatlantic.

Market Trends

The global economy continued to lose steam in the third quarter according to global measures of economic activity and confidence with a sharp slowdown in the US, Europe and China. Global purchasing manager’s indices for September all signaled slowing growth. The global composite PMI flatlined in September at 49.7 although the figure excluded input from China and India due to public holidays. A figure below 50 shows a contraction in manufacturing sentiment. The global manufacturing orders-to-inventory ratio also fell further in September, dropping to 0.94 while manufacturing export orders also slipped. This will further impact the container shipping market which has already seen negative volume growth in most trades between May-July. It is likely the slide in spot container freight rates continue.

Trending Topic

While port congestions are improving gradually across Asia, North America and Europe, volume prospect remains to be weak. The change from sudden boom into current low demand situation will require further adjustment in customer’s sourcing and purchasing plan as well as carriers’ network, which can lead to uncertainties and further disruptions to the supply chain in coming months.

Matching capacity with demand: With forecast reductions in cargo demand Maersk is taking steps to balance capacity with expected volumes on the main trades connecting Asia-North America, Asia-Europe and Asia-Mediterranean over the coming weeks. Our overall goal remains to provide our customers with predictability and to ensure minimal disruption to their supply chain. In cases of blanked sailings and vessel sliding, we will supply alternative routings and coverage for affected vessel positions, and Cargo transfer will be arranged to minimize the impact on customers’ business.

Bottlenecks across the Transatlantic network mean we have also had to reschedule sailings on out TA5 and TA6 services. This situation is driven by several external factors, chiefly terminal congestion, which has contributed to an accumulation of delays on our services resulting in gaps in the departure schedules that require adjustment. Full details of the service changes on the Asia and Transatlantic services can be found on our customer advisories page here: Advisories | News & Advisories | Maersk

High inflation levels and cost of energy continues to be a key concern for consumers, and at present reducing the demand for transportation services. The pace of market normalization has been faster than expected, and the combination of lower sales and shorter lead times (from reduced congestion) is resulting in full warehouses in US and Europe. We expect that inventory levels will stabilize through Q4 and a return to normal bookings patterns. At Maersk we are working closely with our customers to support them through this period of turbulence, offering options of both speeding up and slowing down cargo arrival to match the temporary change in demand pattern, and we are seeing a consistent improvement in the timeliness of both loading and delivery of containers.

Pacific North-West services: Rail congestion and berthing restrictions in Vancouver have made it difficult to maintain schedule reliability on our TP9 and TP1 services throughout 2022 both in terms of departure frequency and extended transit times. Consequently, we will merge the TP1 and TP9 loops into a new TP1 service covering Vancouver and Prince Rupert from late October. The existing call at Seattle will be moved to our existing TPX service while our currently infrequent TP7 service will be suspended. Nansha and Kaoshiung will be covered via alternative products. Full details of the service changes can be found here: Service Changes - Merger of TP1 and TP9 as well as TPX and TP7 | Maersk

South Africa port strike: Disruption to services calling at South African ports will continue into November even though a dockworkers strike that closed all the major terminals operated by state- owned operator Transnet ended around October 20. Maersk and partner carriers operating mainly Asia-Africa and Middle East-India-Africa services have announced several skipped calls at Durban, Cape Town and other ports. Cargo will be transshipped onto other services and routed back via Singapore, Pointe Noir, Walvis Bay and other ports in early/mid-November. Maersk said in a customer advisory that the impact “will be felt for weeks to come and ongoing network contingencies will be needed to offset delays on cargo arrival and loading of exports”. Transet said in a statement that cargo backlogs in container terminals at major ports including Durban and Cape Town meant that the force majeure declared when the strike started on October 6 is expected to be lifted by October 31. Details of the affected services and Maersk’s contingency plans can be found here: Advisories | News & Advisories | Maersk

Key Market Outlook Across Trade Lanes

| Trade | Trade Statement | The most critical destination port situation update |

|---|---|---|

|

Trade

Asia Pacific - North Europe

|

Trade Statement

October demand outlook is quite stable. We are adjusting our network to restore schedule integrity and reliability; This means we may remove a vessel from a string and deploy it in another string instead.

All our network adjustments are communicated through customer advisories, in which we detail the transfer plan onto different vessels. |

The most critical destination port situation update

Congestion remains a major concern across North Europe ports.

Low demand and full warehouses mean customers are reluctant to pick up their import units from the terminals, leading to high yard density. We have seen labour strikes most recently in Felixstowe and Liverpool. Impact on our vessel schedules has been less severe than in previous months due to declining volumes. For now, no further strikes have been announced, but unrest remains with the labour unions and it is very well possible that we will experience further disruptions before the end of the year. |

|

Trade

Asia Pacific - Mediterranean

|

Trade Statement

October demand is softening. Flat demand may continue in November as well. Vessels are being delayed by congestion at both origin and destination so we will continue with voyages reset or network adjustment to recover schedule reliability. All of those actions are communicated through Customers Advisories in which we detail the transfer plan onto different vessels.

|

The most critical destination port situation update

Below ports face 2-3 days of delay

Trieste : due to high yard density Koper : due to high yard density Rijeka : due to high yard density Valencia: Berthing line-up congestion Sines: Berthing line-up congestion |

|

Trade

Asia Pacific - North America

|

Trade Statement

Overall, Asia Pacific to North America space is available. North American ports situations is improving, however, the capacity loss is still expected to happen in coming weeks due to missed sailings caused by the previous port congestion especially Vancouver and Prince Rupert. Our ambition is to make service to gradually recover to weekly coverage in Q4.

USEC port congestion deviates from port to port, overall waiting time is 0-3 days but Baltimore and Houston congestion is 5-20 days. Los Angeles and Long Beach waiting time has been improved to 0-3 days. The LA/LB transit time of our services is quite competitive in the market now. Please reach out to Sales for detail. From late October onwards, we will have network change on TP1, TP9 and TP7, the goal is to relieve the pressure of Vancouver terminal by streaming port calls on all Pacific North-West services, we will share the change on Maersk.com once it is confirmed, please watch this space! Meanwhile, even though the North American ports situations has improved recently, we still see some delay of vessel because the downstream impact of previous congestion, we would kindly suggest our customers to prepare more lead time between ETA and actual departure time. |

The most critical destination port situation update

|

|

Trade

Asia Pacific - Latin America

|

Trade Statement

West Coast South America - Still soft demand causing rate drop in November. Long Term contracts fulfillment continue to be on the low side due to large gap of Short Term vs. Long Term rate. Focus on Maersk Spot Offer and Non-operated Reefer target.

East Coast South America - Soft demand and limited recovery after Golden Week. We expect an open East Coast South America network. Focus on Maersk Spot Offer and Non-operated Reefer target. |

The most critical destination port situation update

Low water situation in Manaus impacts the overall capacity intake and cause 2-3 weeks layover time in transhipment port.

|

|

Trade

Asia Pacific - West Central Asia

|

Trade Statement

Demand to Middle East is showing some improvement in October while demand to India/Pakistan is flat and project similar outlook for November, given impact from inflation and economic situation in Pakistan/Sri Lanka. Overall space available from Asia Pacific to West Central Asia market.

|

The most critical destination port situation update

Overall operating normally.

|

|

Trade

Asia Pacific - Africa

|

Trade Statement

In general, market demand is flat after Golden Week, some services are full due to blankings. We will adjust the network to cater market demand. Suggest customers stay close with us for the latest rate update via online SPOT platform.

|

The most critical destination port situation update

Waiting time:

Cotonou: 3-5 days Kribi: 2-4 days Nouadhibou: 4-5 days Dar Es Salaam: 3-5 days Zanzibar: 14 days |

|

Trade

Asia Pacific - Oceania

|

Trade Statement

Australia import demand continues to be flat while New Zealand remains stable.

SPOT opportunities are open. In order to protect service reliability, Southern Star service drops Brisbane call from second half of October. All communications are via Customer Advisory. |

The most critical destination port situation update

Auckland Port waiting time is up to 14 days causing vessels delay.

|

|

Trade

Oceania-World

|

Trade Statement

Exports to South-East Asia continue with strong demand due to the impending grain season harvest. National 20ft food quality containers remains in deficit and Maersk continue to reposition containers to meet demand best possible. Additional capacity has been made available to accommodate strong Freemantle exports.

Space remains available from Sydney and Melbourne to Greater China and customers can easily make a booking on our Maersk Spot platform. Landside disruption on the Australian East coast is expected to remain impacted by severe weather and heavy rainfall, we encourage customers to reach out to your sales representative should you need support with transport or warehousing space during this time. US West Coast congestion has been alleviated with delays reduced to 0-5 days, our OC1 service, connecting Oceania to the Americas, remains best in class with schedule reliability at 93% for August. Sydney and Melbourne to New Zealand remains to have space available, offering a best in class Trans Tasman solution, across 4 weekly departures. |

The most critical destination port situation update

LA and Long Beach ports have reduced waiting time to 0-5 days. A marked improvement on recent delays.

Philippines ports congestion has eased with space now available into Luzon ports. Auckland port congestion remains with waiting time up to 14 days. The PANZ service will omit Auckland for 3 sailings due to delays. |

|

Trade

Import-Asia Pacific

|

Trade Statement

Average vessel waiting time at Asia ports is healthy at 0~2 days. China terminals operate normally overall despite sporadic covid cases outbreak.

Europe and North America port congestions still exist but expect slight improvement. Reefer freetime extension products for both Maersk and Hamburg Sud are available as an alternative solution to flexibly arrange supply chain. |

The most critical destination port situation update

Changsha barge service temporary suspension due to low water. Suggest to book to nearby port Yueyang as alternative solution.

Single booking container limitation has been expanded to 60x20GP or 50x40GP maximum on last leg barge from Hong Kong/Nansha/Chiwan to Qinzhou/Beihai/ Fangcheng. Sakura service has been deployed with larger vessels to cater for more demand into Japan. Capacity upgrade effective from mid October. Luzon ports (Manila, Batangas, Subic) congestion has been solved without booking restriction. |

Retail Vertical Insight

Retail-Lifestyle outlook: Overstocking, supply chain challenges and falls in demand are expected to hit shipments of retail lifestyle products to the US and consumers there become more price conscious, according to a latest Maersk forecast. While US consumers will likely spend less in the 2022 holiday season, volumes of retail-lifestyle products from Asia are expected to drop 19% in September-November, according to our forecasts from Asia-Pacific’s top 20 SCM customers.

But despite these challenges, Asia Pacific is expected to remain the fastest growing region for contract logistics, growing from a market worth of Euros95 billion in 2021 to Euro 135 billion in 2026, according to a report this year by Transport Intelligence. Asia Pacific’s share of the contract logistics market is expected to grow from 39.8% in 2021 to 44.8% in 2026, while both Europe and North America will see a contraction in market share, the TI report said.

Most of the growth will come from retail in China and India, supported by online marketplaces, automotive in China and pharma in India, while exporters of high-tech electronics will take advantage of external demand to push forward growth, the report added.

Fast Moving Consumer Goods Vertical Insight

The global market has witnessed increased demand volatility in recent years. This has forced Fast Moving Consumer Goods (FMCG) businesses to deal with capacity constraints, container shortages, and port congestion in the absence of transparency and predictability in their supply chains.

Traditionally, FMCGs sell through a retailer and therefore, direct connection to the customer has been limited. However, the rise of digitization, eCommerce, and omnichannel solutions is bringing brands much closer to the consumer than ever before.

New economies today play a significant part in global FMCG sales with Asia being the biggest market both in terms of growth and actual sales. This is in part driven by China but also countries such as Thailand, Vietnam and the Philippines are also experiencing a rapid rise of consumers with more disposable income. By 2030, it is estimated that more than two-thirds of the world’s middle-classes will live in Asia.

Source: EY Global

According to a study by Nielsen, online FMCG sales will overtake offline by 2037. Asia is the biggest market with online FMCG sales in South Korea and China at 20% and 15% of total FMCG market share respectively. FMCG online value growth is dominated by developing countries with countries such as Mexico, Brazil, Colombia, and Thailand experiencing dramatic increases when compared to developed nations. It is worth noting that these are pre-COVID-19 figures and, if anything, the global pandemic has accelerated the growth of online sales faster than anyone could have predicted.

Source: Nielsen , Future Opportunities in FMCG E-Commerce: Market Drivers And Five-Year Forecast

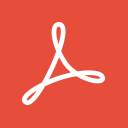

Global consumer spending on Food & Beverage is expected to reach US$ 11,080 billion by 2025.

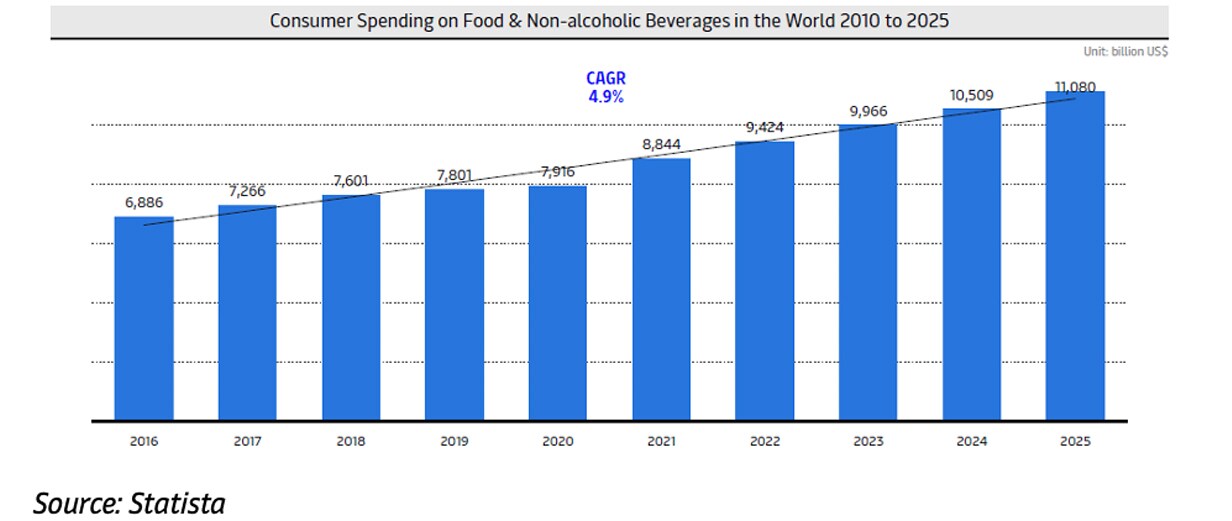

In 2021, Asia Pacific and Europe respectively contributed 31% to the global Food & Beverage market. Asia Pacific region is forecasted to become the biggest in Food & Beverage market by 2023 with approx. CAGR 6% till 2025.

The Western Food & Beverage companies which own world’s leading Snack & Confectionery brands lead the market. But when taking a look at their annual reports their biggest consumption/ addressable market lies in Asia Pacific region. From the production side as well, the Asia Pacific based companies from China, Japan and South Korea are fast emerging as the world’s leading Food & Beverage companies.

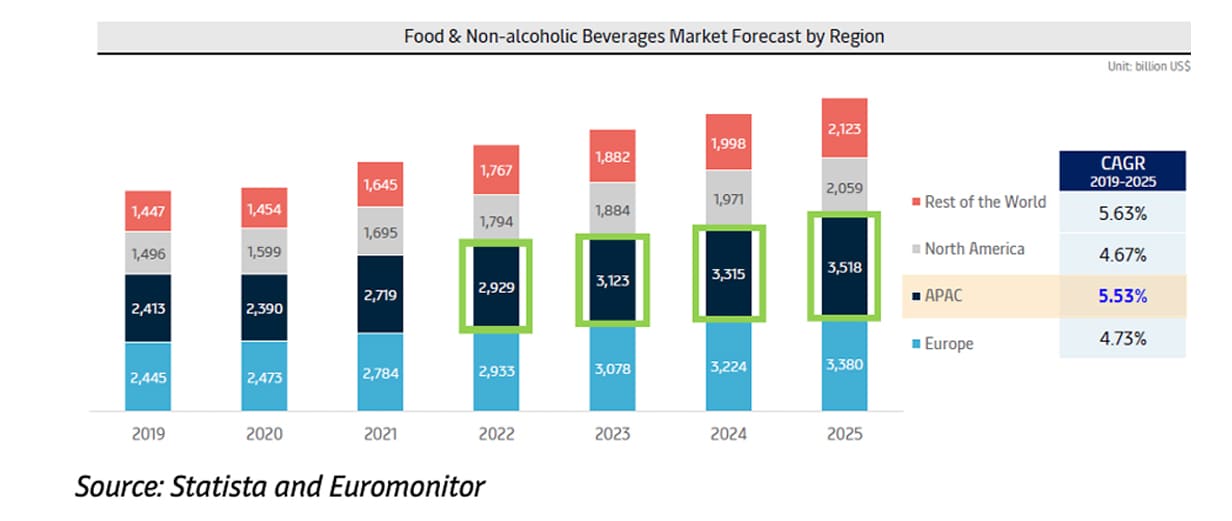

The online share of the Food & Beverage has been lower than non-Food categories. But it is expected to grow by 8% annually from 2020 to 2023. Asia is leading online food with the fastest growth rate and will reach US$ 566 billion by 2025.

FMCG customers manage an annual budget, equivalent to 6% of the revenue to support the company’s growth ambition that mostly centers around ‘Uprise in Asia’ and ‘Keep Growing in Asia’.

Please click here to learn more about Current Trends and Challenges in FMCG Supply Chains. Meanwhile, there is an on-going campaign on FMCG vertical, aiming to bring our customers better visibility in the need for agility in Food and Beverage logistics and the keys to compliance. Please click here to download the free e-book.

Air Update

Greater China: Airfreight rates from China to the US fell to USD6.58/kg in October, a drop of 39% compared with October last year. That comes as the airfreight market is facing an uncertain outlook amid flat export demand in September due to rising interest rates and energy prices and high inventory levels in destination markets. But carriers this year have not seen the level of cancellations as last year due to China’s Golden Week holiday between October 1-7. Airlines are adjusting their fuel surcharges to reflect the decrease in spot jet fuel prices. With Hong Kong and Japan easing COVID-19 related travel restrictions airlines are expected to increase capacity which will impact the balance between cargo demand and aircraft capacity, especially in North Asia.

Maersk Air Cargo, our dedicated freighter service, will take off soon and we are looking forward to serving our valuable customers with this integrator solution.

Japan: International air cargo volumes through the country’s airports dropped 11% to 287,978 tons in August compared with a year earlier which included a 14% fall in exports to 76,103 tons. But Nagoya saw a 19.6% increase in airfreight volumes in September to 10,764 tons, the third straight month of year-on-year gains, according to Nagoya Customs.

Vietnam: Cargo demand for both import and export in the fourth quarter is still very low compared with market forecasts due to a higher inflation and economic declines in major overseas markets.

Australia: Freight rates are showing signs of falling while transit times are improving in October, while capacity remains largely balanced between cargo demand and capacity supply.

For China market, freight rates are improving in the lower and higher weight scales. Rates in Hong Kong market are also improving with a reduction in fuel surcharges from October 1 from HKD6.10/ kg to HKD4.70/kg on chargeable kgs. Airlines are considering adding capacity between Hong Kong and Australia and New Zealand following the lifting of Hong Kong travel restrictions on September 28.

There has also been a 24-hour reduction in transit times from Shanghai to Sydney and Melbourne.

Elsewhere, freight rates could fall on Indonesia-Australia routes after Qantas added flights to Sydney and Melbourne.

In Bangladesh, freight rates for cargo over 500 kg have eased while rates for freight below 500 kg have increased slightly. In India, cheaper freight rates are being offered from Channel although they remain the same for all other airports.

Trans-Tasman airline capacity continues to be heavily constrained and best freight rate options are at spot levels.

Maersk has proactively secured capacity on major airfreight trade lanes to ensure limited peak season disruption.

Inland Services Update

China: A raft of new barge services have been established as Maersk teams have developed new corridors to meet customer demand. Warehouse operations in Chinese Mainland, Hong Kong SAR and Taiwan are operating normally.

Details of the barge services are as follows:

- North China area: New barge corridors have been officially launched between Rizhao-Qingdao (export/import) and Lanshan-Qingdao (export/import) and customers are able to choose from three contracting modes. We have also reactivated a barge service between Zhengzhou-Qingdao with a special promotion rate that will last until the end of this year.

- East China area: The Changsha barge service along the Xiangjiang river has been suspended due to the dry season. We suggest customers choose the trucking service from Changsha to Yueyang. There is also sufficient capacity on the sea-rail service to Shanghai and Ningbo and more bookings are welcome.

- South China area: New barge services for export cargo have been established between Beijiao-Yantian, Beijiao-Shekou, Zhongshan-Yantian, Zhongshan-Nansha, Xiaolan-Nansha, Dongguan-Yantian/Shekou/Nansha/Hong Kong. There is a new barge service for import cargo between Hong Kong-Yantian. We have a strong network and sufficient capacity for trucking and sea-rail services.

Market demand for LCL in October is seeing a downward trend on the Europe, transpacific and other long-haul trades, while for Intra-Asia it is slightly more stable than in September. Carriers have blanking sailings and consolidate some services in response to the weakened demand, but this is not expected to impact stability and reliability. We have added more and more lanes in Maersk.com so that our customers can easily and quickly get the rate and place bookings for all trades.

Philippines: The Sealand IA1 service is replacing the IA3 ex-Luzon with better, direct connectivity to North and East China. There are strong reefer imports into the Philippines and plugs are being allocated for all carriers across the Luzon terminals to manage capacity.

Indonesia: Inland cargo volumes have been showing a downward trend in the last two months with exports being affected most as shippers report low order volumes from buyers. The situation is expected to continue in October.

Trucking capacity remains healthy and there should be no problem catering for inbound volumes. Inland export cargoes are dominated by retail & lifestyle, industrial and automotive while imports are mainly industrial raw materials and automotive spare parts.

Japan: Trucking capacity remains stable although customers are advised to place transportation orders in advance to secure space.

Major Ports Update

|

Vessel Waiting Time Indicator Less than 1 day |

Vessel Waiting Time Indicator 1-3 days |

Vessel Waiting Time Indicator More than 3 days |

|

|---|---|---|---|

|

Asia Pacific Ports

|

Vessel Waiting Time Indicator

Less than 1 day

Busan, Qingdao,

Shanghai, Shekou,

Xiamen, Yantian,

Nansha, Hong Kong,

Singapore, Tanjung

Pelepas

|

Vessel Waiting Time Indicator

1-3 days

Ningbo, Tauranga,

Lyttleton, Napier, Port

Chalmers, Sydney,

Melbourne, Brisbane

|

Vessel Waiting Time Indicator

More than 3 days

Auckland

|

|

Rest of World

|

Vessel Waiting Time Indicator

Less than 1 day

Charleston, Norfolk, Apapa, Tin Can, Tema, Lome, Onne, Pointe Noire, Dakar, Conakry, Maputo, Beira, Balboa, Cartagena

|

Vessel Waiting Time Indicator

1-3 days

Long Beach, Los Angeles, Seattle, Miami, Haifa, Rijeka, Poti, Valencia, Sines, Abidjan, Luanda

|

Vessel Waiting Time Indicator

More than 3 days

Koper, Oakland, Prince Rupert, Vancouver, Newark, Houston, Savannah, Baltimore, Koper, Cape Town, Cotonou, Kribi, Matadi, Dar Es Salaam, Zanzibar

|

Remark: Numbers are dynamic and subject to change.

Resources and tools to support you

Visit our “Insights” pages where we explore the latest trends in supply chain digitization, sustainability, growth, resilience, and integrated logistics.

Learn what’s happening in our regions by reading our Maersk Europe and North America and Latin America updates.

Visit us at Maersk.com to handle everything from “Last Free Day” to online payments.

We value your business and welcome your feedback. Should you have any questions on optimizing your cargo flows, please contact your local Maersk professional.

Anything you need, we’re here to help

By submitting this form, I agree to receive logistics related news and marketing updates from A. P. Moller-Maersk and its affiliated companies via e-mail. I understand that I can opt out of such Maersk communications at any time. To see how we process your personal data, please see our Privacy Notification.