When transporting cargo, we know how important it is that it reaches its destination safely. Everyone is familiar with insurance, whether for their home, car, pets, or travel. But outside of our personal lives, it can be confusing, especially when protecting cargo destined for an ocean voyage. With the different options available, deciding which type of cover to choose can pose some challenges.

In this article, we hope to provide the clarity you need to select the right option for your cargo.

What types of cargo cover are there?

As with your personal cover, there are numerous ways to protect your cargo to best suit your needs. Here is an overview of three key options when shipping cargo including sea transport: standard ocean bill of lading, extended liability coverage, and cargo insurance.

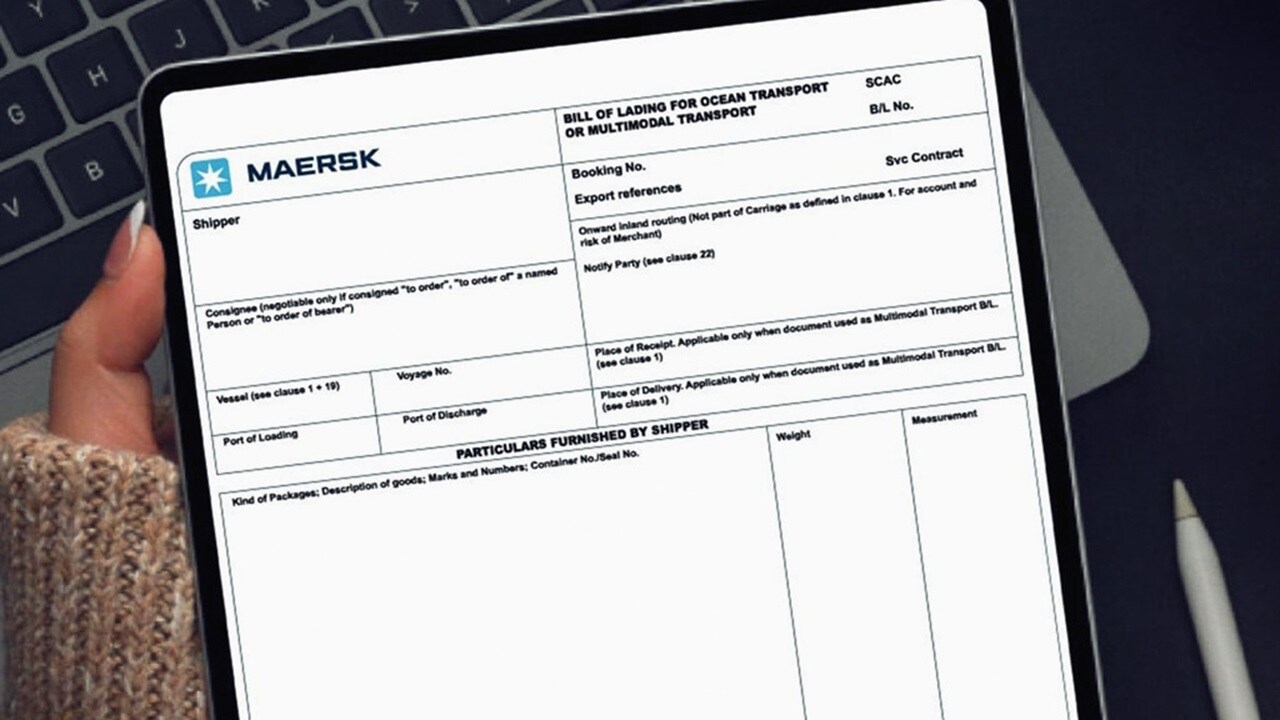

What is a standard ocean bill of lading?

Every ocean shipment is transported on an ocean bill of lading, a legal document issued by the shipping carrier that serves as a receipt for the goods transported by sea and acts as a contract of carriage between the shipper and the carrier.

So, how does this relate to cargo protection? Well, on the reverse of the bill of lading (B/L) are the terms and conditions, some of which have been extracted from the Hague-Visby Rules, and within those terms and conditions are certain provisions stipulating carrier and shipper liability.

Who is liable with a B/L?

In some circumstances, the carrier is liable for cargo damage – but only to a point. Take, for example, a situation where an equipment problem (e.g., a hole in the container or a reefer malfunction) has caused damage to the cargo. If the B/L stipulates that the carrier is liable, they must compensate the customer for their loss. However, despite being responsible, as per the terms and conditions of the B/L, the compensation amount is capped at 2SDR (Special Drawing Rights) per kilo. The SDR value is determined daily based on market exchange rates, which means it fluctuates, and compensation is calculated based on the cargo weight, which, in most cases, is well below the cargo value.

Using a B/L as your cargo cover is always in place, but the coverage is minimal in terms of the extent of coverage and compensation. In a nutshell, it can only protect you so far, and in cases like fire, theft, or delay, it does not provide any cover at all.

What is Extended Liability Cover?

Often mistaken for insurance, extended liability cover extends the liability for terms of carriage to include things not typically covered in standard terms, such as damages caused by delay or fire.

Take a fire on board the vessel, for example. Under a normal B/L, despite the customer not having any influence on the fire and their cargo experiencing damage or total loss, the customer would not be able to claim from the carrier as the B/L terms and conditions protect the carrier. In the case of extended liability coverage (if stated in their cover), however, they could claim from the carrier up to the compensation limit allowed as per their agreement. The extended liability company claims team would handle the claim, and insurance companies would not be involved.

Taking out an extended liability product can be a simpler way to cover cargo. It is more structured, has a fixed cost and compensation limit, and has a simpler claims process and shorter resolution time. As it is not insurance, it does not require involvement from insurers or brokers, and you usually have one point of contact.

How much will it cover?

While extended liability cover generally provides greater protection than a standard B/L, the actual compensation you can expect in the event of loss or damage may still be well below cargo value.

For instance, if a shipment of electronics worth $500,000 is lost due to theft and the carrier’s extended liability only covers $100,000, the shipper would suffer a significant loss if they didn’t have any other coverage.

Tip: Each company has different terms and conditions for any product or policy, so it is always best to check with the provider before deciding on a cover.

What is Cargo Insurance?

Cargo insurance is a specialised form of coverage that protects against financial losses due to the loss, damage, or theft of goods during transportation by land, sea, or air. It covers the full value of the cargo, regardless of whether the carrier is at fault, and provides comprehensive protection against a wide range of risks such as accidents, natural disasters, fire, and theft. Unlike extended liability, which only increases the carrier's basic legal responsibility up to a limited amount, cargo insurance guarantees that the shipper will be reimbursed for the full value of the goods, even if the carrier's liability is insufficient or the carrier is not liable.

Here’s s a quick overview of the key differences between an ocean bill of lading, extended liability cover, and cargo insurance:

| Ocean Bill of Lading | Extended Liability | Cargo Insurance | |

|---|---|---|---|

|

Coverage scope

|

Ocean Bill of Lading

Limited by caps outlined in Hague-Visby Rules; calculated based on cargo weight, which is generally well below cargo value

|

Extended Liability

Limited by legal caps; covers only carrier's legal responsibility, which may be insufficient for high-value cargo or if the carrier is not directly at fault.

|

Cargo Insurance

Covers a broad range of risks and losses, regardless of fault; provides comprehensive protection

|

|

Fault vs

no-fault |

Ocean Bill of Lading

Shipper vs carrier liability stipulated in Hague-Visby Rules; only provides minimal compensation even when carrier liable

|

Extended Liability

Applies only when the carrier is legally at fault or negligent; does not cover events outside carrier’s control (e.g., natural disasters or third-party actions)

|

Cargo Insurance

Covers losses regardless of fault; protects against various risks, including natural disasters

|

|

Applicability and Voyage

|

Ocean Bill of Lading

Ocean only; bill of lading

|

Extended Liability

Ocean and Road; bill of lading

|

Cargo Insurance

All modes of transportation; as specified during purchase including moves outside of bill of lading

|

Where to next?

Maersk offers both an extended liability product and cargo insurance, ensuring we can find a solution for your needs.

For more information, explore our extended liability product Value Protect and our cargo insurance pages, where you will also find links to contact your local sales representative.

Sign up for our logistics newsletters

Receive news and insights that help you navigate supply chains, understand industry trends, and shape your logistics strategy.

Thank you for signing up

An unexpected error occurred

Sorry but we were unable to sign you up for newsletters.